The Required Amount at the Prescribed Rate (Handcrafted From the Finest Corinthian Leather)

Showing posts sorted by relevance for query ha-joon chang. Sort by date Show all posts

Showing posts sorted by relevance for query ha-joon chang. Sort by date Show all posts

Even More Ha-Joon Chang Analogies!

In his book Bad Samaritans: The Myth of Free Trade and the Secret History of Capitalism, Ha-Joon Chang accuses wealthy countries and their financial institutions of historical revision, and comprehensively proves that it was not the free market led these countries to success-- and in his chapter on intellectual property law he cites the Mickey Mouse Protection Act, or the law that extended copyright protection to the life of author plus 70 years (it was originally 50) and Chang doesn't propose the removal of all copyright law, but he does point out that for developing nations to actually develop, they need to implement first world ideas and technology yet they cannot afford to abide by the same rules as nations that are already technologically developed, and so he uses an analogy to explain his perspective . . . and since I am the main content provider for people in need of summaries of Ha-Joon Chang analogies, I will paraphrase it here: Chang says the amount of copyright law a country needs is like the amount of salt the human body needs: no salt will kill you, and too much salt is very unhealthy, but a little bit is beneficial . . . and the life of the author plus 95 years, even if it means anyone can have their way with Minnie Mouse, is too much salt.

Back By Popular Demand! More Ha-Joon Chang Analogies!

Some analogies are so bad they're stupid; some analogies are so bad they're funny; and-- of course-- some analogies make a lot of sense, and help you to understand something complex in simpler terms . . . and in Ha-Joon Chang's book Bad Samaritans: The Myth of Free Trade and the Secret History of Capitalism, he uses a couple of metaphors to summarize his comprehensive data on free market history: 1) he accuses rich countries of what Friedrich List called "kicking away the ladder," which means that they arrive at economic stability and wealth through complex and strategic protectionism, tariffs, regulation of foreign investment, regulation on imports and exports, and subsidies-- but then once these these nations (and he uses America, Britain, and his home country of North Korea as his prime examples) have reached a position of economic power, they use institutions such as the WTO and the IMF, treaties, embargoes, copyright law, and tariffs to force impoverished nations into adopting extreme free market policies despite the fact that these countries are not ready to compete in a free market . . . and so, the rich nations use the ladder to climb, and then kick it away when poor countries want to use the same method 2) Chang's second metaphor about the irrationality of the current free market ideology centers around his six year old son, Jin-Gyu, who he ironically claims is "living in an economic bubble . . . over-protected," and so he "needs to be exposed to competition" . . . in other words, he should get a job-- he could be a successful shoe-shine boy or street hawker and learn the value of hard work-- but, of course, we don't do this to our children, we protect them for many years from the competitions of the free market until they can develop intellect enough to take part in the competition for the best jobs . . . and he compares this absurdity to how "free trade economists claim that developing country producers need to be exposed to as much competition right now, so that they have the incentive to raise productivity in order to survive . . . protection by contrast, only creates complacency and sloth," and Chang points out that this "infant industry argument," was proposed by the inventor of another great economic metaphor-- Adam Smith-- who claimed that an "invisible hand" guided the free market to efficiency, but even Adam Smith understood that free markets and protectionism need to exist in concert, not opposition.

Humble Buffet

I shouldn't be reading heralded economist Ha-Joon Chang's book 23 Things They Don't Tell You About Capitalism, because I'm trying to keep my happiness index up and thinking about economics never leads to greater happiness, but it's frustrating when politicians are saying their hands are tied about budget cuts, yet they won't consider raising taxes on the rich (or even renewing a current tax on the rich!) despite the fact that the rich in America earned their money just as much because of the American system as because of their wits-- as Chang puts it: there's no such thing as a free market; every market is regulated and stipulated by its context and the rich are beholden to that system for their wealth . . . but don't listen to me, listen to Warren Buffet, who said: 'I personally think that society is responsible for a very significant percentage of what I've earned . . . if you stick me down in the middle of Bangladesh or Peru or someplace, you'll find out how much this talent is going to produce in the wrong kind of soil . . . I will be struggling thirty years later . . . I work in a market system that happens to reward what I do very well-- disproportionately well."

A Useful Analogy (Hindsight is 20/20)

Ha-Joon Chang, in his book 23 Things They Don't Tell You About Capitalism, makes a case for increased government regulation of the financial sector, despite the logic that "the government does not know better than those whose actions are regulated by it . . . the government cannot know someone's situation as well as the individual or firm concerned" and so "government officials cannot improve upon the decisions made by the economic agents," but he explains that regulations often work not because the government "knows better," but because the regulations limit complexity, and of course this applies to the sub-prime mortgage crisis, where the financial instruments and derivatives were more complex than the experts and investors could predict, and Chang makes this useful comparison: when a company invents a new drug it cannot be sold immediately . . . first the drug needs to be rigorously tested on carefully monitored patients because the interactions of a new drug in the human body are complex and unpredictable, and it will take a while to tell if the new drug has more positive benefits than its side effects . . . and, of course, this was not done before we sold unregulated sub-prime mortgages, packaged them into mortgage backed securities, packaged those into collateralized debt obligations, and insured those with credit default swaps . . . and it turns out the side-effects of this financial treatment are nausea, irritability, unemployment, mental confusion, erectile dysfunction, depression, problems sleeping, constipation, diarrhea, kidney failure, hostility, hallucinations, canker sores, foreclosures, and panic attacks.

Chang vs. Jeter vs. Ridley! To The Death!

Matt Ridley's new book The Rational Optimist: How Prosperity Evolves reminds us that even though many people are professing the end of days because of the sub-prime mortgage crisis, high gas prices, a stagnant economy, rising food prices, and climate change, that people are still living better than at any other time in human history, and he argues that this is because of specialization and free-trade-- and credits David Ricardo for realizing this-- and this system of eschewing self-sufficiency and instead pursuing markets and trade enables ideas to mix and mate and reproduce, which leads to a higher quality of life for everyone involved, but sometimes he oversimplifies his thesis, especially when he makes over-arching statements like this: "The message from history is so blatantly obvious-- that free trade causes mutual prosperity while protectionism causes poverty-- that it seems incredible that anybody ever thinks otherwise," and then Ridley claims that there is "not a single example" from history of a country opening its border and ending up poorer . . . which is the logical kiss of death; Ha Joon Chang provides comprehensive examples of when protectionism is necessary for a country to thrive, and John Jeter provides examples of countries who opened their borders to the forces of global markets and became impoverished . . . so I guess these guys need to arrange a time and a date and settle this debate out in the streets.

Hey Trump! Huge Bigly News!Solar Is Winning! The Bums Won!

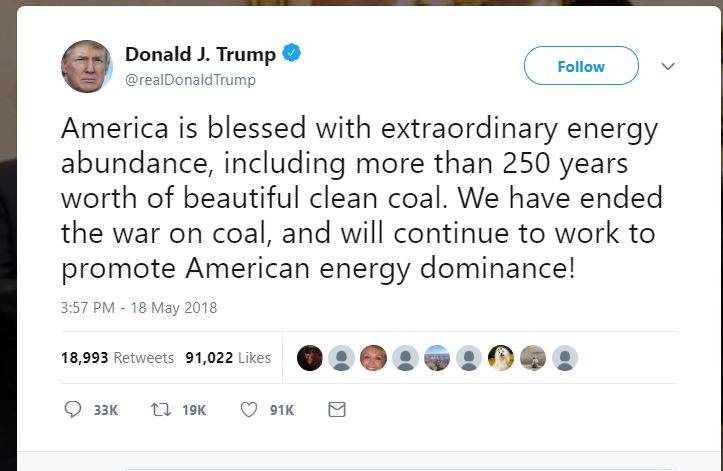

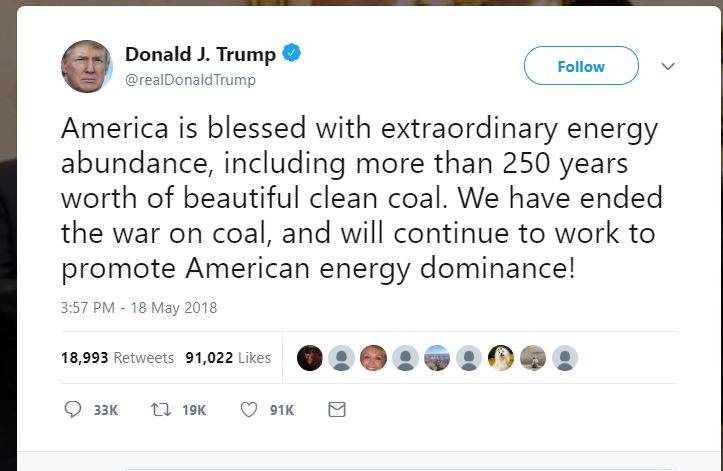

You probably haven't heard the hugely great news, the most important incredible wonderful bigly news for our planet. In fact, if our Toad-in Chief were to have his druthers, you'd believe this is The deal:

Beautiful mining accidents? Beautiful exploding mountaintops? Beautiful polluted rivers and streams? Beautiful particulate caused asthma? Beautiful waste and disposal issues?

It's impressive how sincerely Trump can use words like "clean" and "beautiful" in such a bigly and hugely opposite manner of all past precedent. He's going to give the OED practical usage team some homework.

Anyway, I'd like to implore Trump to revise his earlier tweet. It's fake news. The first thing Trump is going to need to do is to acknowledge that the war on coal has not "ended," it has just begun. And so has the war on natural gas and fracking. Actually, the term "war" is a bit violent for something so positive . . . for a transition to something so clean and beautiful. And cheap. America loves cheap. If Trump embraces this, he could change the world. I'd even have a modicum of respect for him, if he could set the record straight.

The big news? Solar power has just crossed the threshold. It is now cheaper than coal. Beautiful, clean solar energy-- the hippies' dream-- is now affordable.

If you want a nine-minute overview of this amazing economic moment, check out The Indicator's "Why Cheap Solar Could Save the World." We did it exactly as Ha-Joon Chang describes-- with a combination of government subsidies that incentivized the technology and manipulated the market, leading to technological innovation. Not exactly the way Adam Smith envisioned. Things are a little more complicated than the conservative's wet dream of simplistic supply and demand/invisible hand capitalism.

But I digress. And that stuff is way to hard for Trump. All he needs to do is Tweet the news and apologize for his errors.

But even if Trump did that, it doesn't guarantee victory. We live in America. Even if Trump disappears, the folks who voted him in won't. Big energy has a lot of lobbying power. Trump and his followers have a brand attachment to coal which defies environmental logic (but makes perfect political sense). After coal, the next battle will be frakking. It could be the key to the election.

Conservatives struggle with the associations surrounding solar power. It's hippy dippy. But we are way past the days when Reagan removed the solar panels on the White House. If the Blackstone Group is investing heavily in solar power, then the hippies have won.

We need to pass the news to Trump (who certainly won't hear about this on FOX News). And the Dude needs to pass the news along to The Big Lebowski. The revolution isn't over. The revolution has just begun. The bums didn't lose.

The bums won!

Beautiful mining accidents? Beautiful exploding mountaintops? Beautiful polluted rivers and streams? Beautiful particulate caused asthma? Beautiful waste and disposal issues?

It's impressive how sincerely Trump can use words like "clean" and "beautiful" in such a bigly and hugely opposite manner of all past precedent. He's going to give the OED practical usage team some homework.

Anyway, I'd like to implore Trump to revise his earlier tweet. It's fake news. The first thing Trump is going to need to do is to acknowledge that the war on coal has not "ended," it has just begun. And so has the war on natural gas and fracking. Actually, the term "war" is a bit violent for something so positive . . . for a transition to something so clean and beautiful. And cheap. America loves cheap. If Trump embraces this, he could change the world. I'd even have a modicum of respect for him, if he could set the record straight.

The big news? Solar power has just crossed the threshold. It is now cheaper than coal. Beautiful, clean solar energy-- the hippies' dream-- is now affordable.

If you want a nine-minute overview of this amazing economic moment, check out The Indicator's "Why Cheap Solar Could Save the World." We did it exactly as Ha-Joon Chang describes-- with a combination of government subsidies that incentivized the technology and manipulated the market, leading to technological innovation. Not exactly the way Adam Smith envisioned. Things are a little more complicated than the conservative's wet dream of simplistic supply and demand/invisible hand capitalism.

But I digress. And that stuff is way to hard for Trump. All he needs to do is Tweet the news and apologize for his errors.

But even if Trump did that, it doesn't guarantee victory. We live in America. Even if Trump disappears, the folks who voted him in won't. Big energy has a lot of lobbying power. Trump and his followers have a brand attachment to coal which defies environmental logic (but makes perfect political sense). After coal, the next battle will be frakking. It could be the key to the election.

Conservatives struggle with the associations surrounding solar power. It's hippy dippy. But we are way past the days when Reagan removed the solar panels on the White House. If the Blackstone Group is investing heavily in solar power, then the hippies have won.

We need to pass the news to Trump (who certainly won't hear about this on FOX News). And the Dude needs to pass the news along to The Big Lebowski. The revolution isn't over. The revolution has just begun. The bums didn't lose.

Keynes vs Friedman . . . with Madrick as Referee

Jeff Madrick's book Seven Bad Ideas: How Mainstream Economists Have Damaged America and the World pits Keynesian economics-- the idea that markets can be extremely erratic and inefficient, especially in times of recession and/or economic chaos, and so active and aggressive financial policy decisions are essential and important-- against the ideas of Milton Friedman (and what those ideas have evolved into . . . a moralistic narrow-minded worship of the beauty and unerring accuracy of the Invisible Hand, free markets, and EMT) and while Madrick keeps it fairly intellectual-- this is not an easy read and certainly not a polemic, it's a point-by-point academic debunking and dismissal of much of what mainstream economists pass for fact (if you want something in this vein that is a little more entertaining, I recommend the writing of Ha Joon Chang) and while you might get bogged down in the chapters about Say's Law and the mathematics of inflation, it's still easy enough to read between the lines and realize how much economic conservatives-- and this includes Bill Clinton-- have fucked things up, by thinking that the abstract elegance of the Invisible Hand means that the axiom (mentioned once by Adam Smith) is the absolute be-all-end all in economics, some universal truth like the Golden Rule (and we all know that Golden Rule has a loophole-- which is analogous to economics because it deals with irrationality-- you should do unto others as you would have done unto you . . . unless you love a good knife fight . . . if you love a good knife fight and wake up each morning hoping, praying to get into a knife fight, for no reason at all other than you love violence and blood and honing your boot knife and so-- since you love knife fighting-- you do this unto others that you meet, assuming they would love a good knife fight as well, most people would say that's a flaw in the Golden Rule and you're totally irrational . . . it's the same with economics: it would be lovely if markets and people within them were totally rational and all wanted the same thing and had the same information and motivation, but that's not how it works, people move in herds, they panic, they operate without perfect information, in markets that aren't large enough to be statistically accurate, etcetera, etcetera) and the important thing to remember is that economics is NOT math and it has a moral component . . . it has a real effect on people's lives and there are no commandments from on high-- even if they're from the IMF-- that are universally right . . . you'll need to read the book to get the fine points but near the end Madrick summarizes things:

"Economies of scale, the growth of trade, the availability of natural resources, educational attainment, the quality of financial institutions, military spending, the rise of wages, the establishment of unions, welfare programs, the optimism of a people, varieties of attitudes toward materialism, the sense of community, marriage and families, the broadening of freedom-- these are major factors contributing to growth and it is hard to separate one from another . . . there are no adequate universal theories of growth because the nature of growth on a country-by-country basis and over time is too individual and involves too many factors . . this does not stop economists from insisting on a scientific-like one-note explanation of growth"

and so those who propose orthodox supply-side EMT free market economics in the face of every problem-- whether it be a moral, philosophical, sociological, or psychological-- are "profoundly responsible" for what has happened to the American economy and need to realize that these simplistic models are only hypothetical, and have very little empirical factuality . . . this is a must read for politicians and free market advocates, and if our leaders and legislators could be a little more open-minded and creative about economic policy and reform (this can happen, even in the face of lobbyists . . . New Jersey just completely reformed it's corrupt bail system) and realize that markets occasionally work but they are not some universal truth inscribed on a tablet, they are just another economic game with rules and regulations and consequences and incentives, and just like any game, the rules can be massaged and adjusted and outright changed to allow fairer play and better results for all participants and other outcomes . . . football did it with the forward pass (and then pass interference and quarterback protection rules etc. and look at all the scoring) and basketball introduced the three-pointer so that little guys like Stephen Curry could profit as well as big men . . . economics can adapt the same mentality, if people can get beyond this universal acceptance of orthodoxy . . . it ain't religion, it's money.

"Economies of scale, the growth of trade, the availability of natural resources, educational attainment, the quality of financial institutions, military spending, the rise of wages, the establishment of unions, welfare programs, the optimism of a people, varieties of attitudes toward materialism, the sense of community, marriage and families, the broadening of freedom-- these are major factors contributing to growth and it is hard to separate one from another . . . there are no adequate universal theories of growth because the nature of growth on a country-by-country basis and over time is too individual and involves too many factors . . this does not stop economists from insisting on a scientific-like one-note explanation of growth"

and so those who propose orthodox supply-side EMT free market economics in the face of every problem-- whether it be a moral, philosophical, sociological, or psychological-- are "profoundly responsible" for what has happened to the American economy and need to realize that these simplistic models are only hypothetical, and have very little empirical factuality . . . this is a must read for politicians and free market advocates, and if our leaders and legislators could be a little more open-minded and creative about economic policy and reform (this can happen, even in the face of lobbyists . . . New Jersey just completely reformed it's corrupt bail system) and realize that markets occasionally work but they are not some universal truth inscribed on a tablet, they are just another economic game with rules and regulations and consequences and incentives, and just like any game, the rules can be massaged and adjusted and outright changed to allow fairer play and better results for all participants and other outcomes . . . football did it with the forward pass (and then pass interference and quarterback protection rules etc. and look at all the scoring) and basketball introduced the three-pointer so that little guys like Stephen Curry could profit as well as big men . . . economics can adapt the same mentality, if people can get beyond this universal acceptance of orthodoxy . . . it ain't religion, it's money.

I Can See Why People Are Pissed But . . .

Ha Joon Chang, in his book 23 Things They Don't Tell You About Capitalism, explains how in a quest to curb inflation, the free market package known neo-liberal policy, emphasizes greater capital mobility (rich people can move large amounts of money quickly so they can make a killing on arbitrage and investment without penalty) and greater labor market flexibility (the ability to outsource, avoid unions and labor regulations, and essentially make jobs insecure) and these policies are wonderful for those who hold large liquid financial assets and like to move them quickly to avoid having them degraded by inflation and this also allows for large companies to be restructured quickly, but it doesn't help if you own a house or don't have loads of liquid assets or a large business, and the threat of some inflation essentially pales in comparison to job losses and foreclosures and economic instability, especially when people are stuck in houses they can't sell, so they can't take advantage of the greater flexibility companies have in moving jobs (my cousin who works at Pfizer says this is the "new normal," you can be laid off at any time) and because of this instability in the job market, people are pissed at teachers, cops, and firemen because we have a union and collectively bargain for our salaries and benefits (although legislation in New Jersey is trying to abrogate these rights) . . . essentially we have old time jobs that are stable . . . the kind of jobs most people in America don't have any longer . . . but instead of being pissed at us, why not be pissed at the neo-liberal policies that made this happen?

Taking the Purple Pill: Trying to Step Outside the Moral Matrix

This sentence is going to be a random, stream-of-consciousness mess, but I think (for once) my form fits my function: lately, I have been trying my damndest to understand the polarization between liberals and the conservatives in our country, and how this is shaping the current economic policy and the election platforms . . . I've been doing my homework and listening to conservative talk radio-- some Rush Limbaugh and plenty of Mark Levin, and in between the overblown rhetoric, the ranting about Hillary "Rotten" Clinton . . . how she is a felon and a serial liar and the devil incarnate, the disgust with poor people and immigrants, the lack of empathy for people of color, the absolute hatred for the government and its programs and the possibility that our liberties might be curtailed (guns!), the fear of socialism and any redistribution of wealth, the paranoia that taxation and public works projects will just allow the government to get its dirty hands on our money, and like the mafia, take its cut-- as a public school teacher, it's hard to listen to this-- but in between all this vitriol, there is a kernel of an idea that these conservative blowhards are trying to espouse . . . that the government should be smaller and taxes should be lower and regulations should be less and that the best way to produce wealth is an unfettered free market-- and while is think this is true in a limited sense, for certain goods and products, I also think a free market is expensive and volatile with certain things, especially things that we wish to flow: electricity, water, health care, infrastructure . . . we just want these things to be reliable so that other things can work on top of them, and I also think there's a question of externalities, which the conservatives rarely mention . . . but underneath all the hatred there is something to talk about, and I find it interesting that the conservatives don't agree with all Trump has to say, especially on jobs and government infrastructure spending and protectionism and minimum wage . . . meanwhile, the liberals want a revolution-- free college, free healthcare, higher living wages, alternative energy, restrictions on corporations, control of externalities, and equal treatment for all people: rich, poor, immigrant, native, white, black, gay, transgender, and don't mind some redistribution of wealth to encourage this, and I've been listening to the ultra-liberal and fairly funny Citizen Radio to get a bead on some real radical left wing logic and emotions, and while I have more in common with those ideas, they can be really annoying and idealistic and insular and obnoxious as well . . . and it doesn't seem like any of these candidates or their followers are going to do what Jonathan Haidt suggests in his TED talk and "step outside the moral matrix" and actually look at what some smart people have figured out, which is that it's a combination of free markets and regulations that make economies work, and no one knows the exact balance . . . read some Ha-joon Chang to understand "kicking away the ladder," which is how many developed countries arrived at economic stability and wealth through complex and strategic protectionism, tariffs, regulation of foreign investment, regulation on imports and exports, and subsidies-- but then once these these nations (and he uses America, Britain, and his home country of North Korea as his prime examples) have reached a position of economic power, they use institutions such as the WTO and the IMF, treaties, embargoes, copyright law, and tariffs to force impoverished nations into adopting extreme free market policies despite the fact that these countries are not ready to compete in a free market . . . in other words, there's no magic bullet for an economy and it takes a mixture of ideology to understand this, which is what Jonathan Haidt's TED talk is about, his research shows that while there is some consensus between liberals and conservative on fairness/reciprocity and harm/care as valid moral concerns, conservatives tend to be much less open to experience and thus much more concerned with three moral traits that liberals don't interest liberals: purity/sanctity . . . so the strict interpretation of the Constitution . . . in-group/loyalty . . . so "real" Americans and patriotism and military jingoism and Ronald Reagan as God . . . and authority/respect . . . so law and order and belief in the police and a more traditional patriarchy and Christmas and religion and all that . . . and Haidt points out to the mainly liberal crowd (he polled them, and it's a typical TED talk audience: open to progress, science, and new ideas and almost entirely liberal) that BOTH of these mentalities are required to create a great society . . . there needs to be some revolution and progress, but order is also delicate and hard to maintain and actually requires the three moral traits that liberals tend to ignore . . . now Trump throws a bit of a monkey wrench in this because he doesn't seem to be concerned with some typical conservative values-- purity and respect for authority-- and so his economic and policy plans might be something entirely new (and unpalatable in some respects to the "true" conservative) while Clinton certainly can be more jingoistic about the military and more loyal to her group (the Democrats) than a typical rebellious, progress-minded liberal might like and while I know that these two sides are never going to love each other, or even see eye-to-eye . . . conservatives work on a five-channel moral system while liberals work on two-channels, so conservatives will always be annoying to liberals because they care passionately about more stuff and seem angry, and liberals will always seem to be amoral libertine radicals because they don't care about enough things, but we are going to have to embrace the fact that what makes America great is diversity, and Donald Trump and Ted Cruz and Ronald Reagan are part of that diversity, and those conservative views-- which I often find hateful and ranting and humorless-- are important, just as important as the stereotypical diversity most liberals embrace: multi-cultural, multi-gender, pan-religious, multi-ethnic diversity . . . diversity that appeals to people who are open to all kinds of experience, the diversity that leads to a wide-variety of good restaurants, many of them quite cheap . . . such as the new Tacoria in New Brunswick . . . and that's what this is all about, right?

Subscribe to:

Comments (Atom)

A New Sentence Every Day, Hand Crafted from the Finest Corinthian Leather.